| Main index | About author |

Readers with some experience of markets are asked to allow a philosophical observation.

Different markets have different degrees of internal connectivity.

A trader of $/¥ foreign exchange is really trading that one number, in which huge size can change hands for minuscule dealing costs. There might also be positions in $/¥ options, so trading the distribution of the possible outcomes as well as the mean, but, again, it is about that one number.

Equities comprise many weakly-connected numbers. Consider Apple, Johnson & Johnson, J.P. Morgan, Caterpillar: on any given day two of these equities could be up, one about unchanged, and the other down. Yes, there can be a big macro story, going-nicely or yikes!, which can drive the overall level. But after removing that economic good-or-bad, equities are weakly connected.

In contrast, fixed income is deeply connected. The cost of borrowing money for 7 years is closely related to the costs of borrowing for 5 and for 10 years. And the cost of borrowing through different channels, or for different classes of borrower, are not the same, but are closely connected.

Hence fixed income has many instruments, and they are closely connected. So fixed income has a richer and more intricate structure than the other big markets.

— JDAW, May 2020.

This is the whole of the book Pricing Money; PDFs being available in both A4 and US Letter = 8½″×11″ (though some green boxes in the HTML are not yet in the PDFs). But these are not quite free: there is a ‘price’. The price is a review (even if only a few words) on your preferred social media, either tagged #PricingMoney or with the link jdawiseman.com/PricingMoney.html. There is no paywall, nor registration, nor even cookies, so this price cannot be enforced. Nonetheless, please be fair: please post a review or comment or acknowledgement, tagged or linked or both. Thank you.

Preface to the online edition. Pricing Money: A Beginner’s Guide to Money. Bonds, Futures and Swaps was written by J. D. A. Wiseman between autumn 2000 and April 2001, and was published by Wiley in September 2001. On 15 November 2019 Wiley kindly returned the copyright to the author. Following which, the original text is now published at www.jdawiseman.com/books/pricing-money/Pricing_Money_JDAWiseman.html, more concisely reachable via www.jdawiseman.com/PricingMoney.html.

Minor typographical errors have been repaired, but there have been no alterations that change meaning. As browsers have a search facility, the index has been omitted. As this is a web page rather than a physical book, the Acknowledgements have been moved to the end. Modern authorial comment, so not before November 2019, is shown green-boxed.

While stocks last, hard copies of Pricing Money can still be purchased from Wiley, Waterstones, Amazon.co.uk, Amazon.com, Amazon.fr, Amazon.de, Amazon.co.jp, Abe books, as well as other bookshops: cite ISBN 0‑471‑48700‑7.

— J. D. A. Wiseman

London, November 2019

www.jdawiseman.com

Pricing Money is a beginner’s guide: it says so in big letters on the front cover. I believe it to be an excellent beginner’s guide — presumably many authors believe their own books to be excellent — but, being a beginner’s guide, it will not immediately make you a world-renowned expert.

It was written around the turn of the pedant’s millennium. In some parts it shows its age. It has been slightly freshened by the addition of green-boxed updates, but these have been written very concisely, more to point to developments than to explain them fully.

Please do learn from and be informed by Pricing Money. But also be cautious: it is not enough to make you a world-renowned expert; it does not list the many details that are both dull and necessary; some things have changed since it was written; it cannot be your risk manager.

— JDAW, March 2021.

Top; Pricing Money: 2019 Preface; A little philosophy; Cautionary words; Contents; 2001 Preface;

Chapter 1: Money markets

What is money?;

Why there is a money market;

Choosing a maturity;

Repo;

Central-bank money-market operations;

Two money markets;

Regulation Q: history;

The euro;

Only;

Writing money;

Settlement details;

Summary;

Chapter 2: Government bonds

Introduction;

The concept of yield;

Example yield calculations;

Coupon and yield;

The yield curve;

Choice of x‑axis;

Steepness: plural or singular;

Primary dealers;

Government bond markets;

Fewer names;

Repo as part of the government-bond market;

Accrued interest;

STRIPS;

Other tradable government debt;

Non-government debt;

Rating agencies;

Summary;

Chapter 3: Futures

The gold miner’s problem;

The gold miner’s solution;

Contract specification;

COMEX;

Credit and margin;

Cash settlement;

Cash-settling other contracts;

The fixings;

Lɪʙᴏʀ’s start date;

Lɪʙᴏʀ’s weaknesses;

The 3-month interest-rate future;

Price action;

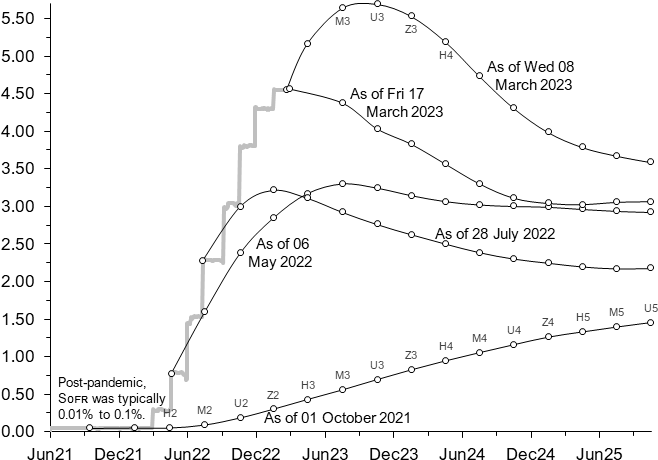

Sᴏꜰʀ futures, Oct 2021–Mar 2023

The strip and TED spreads;

Contango and backwardation;

Arbitrage;

Some trading jargon;

Summary;

Chapter 4: Swaps

Introduction;

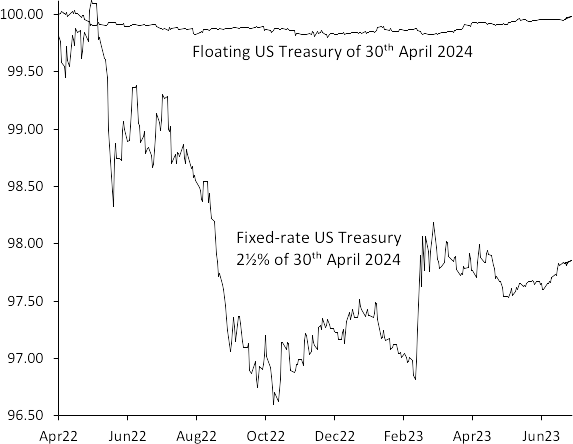

UST floater and fixed;

An example;

Asset swaps;

A typical swap in detail;

Credit risk in swaps;

Trading jargon;

Swaps and interest-rate futures;

Swap collateralisation;

Myth and reality;

Summary;

Chapter 5: Options

Introduction;

Puts and calls;

What is the option worth?;

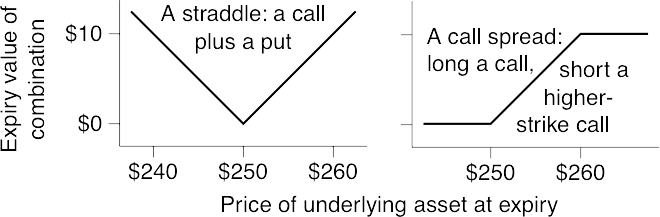

Combinations;

Underlyings;

Embedded options;

Implied volatility;

The VIX;

Summary;

Chapter 6: Foreign exchange

The basic rationale;

Size and conventions;

CLS;

Forwards;

Shake the dice;

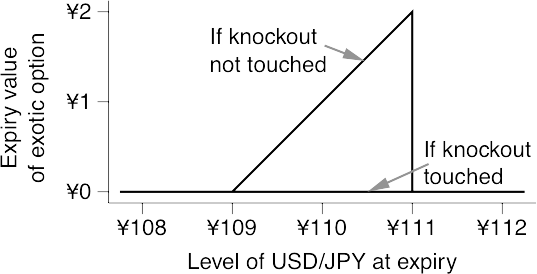

Defending barriers;

Summary;

Chapter 7: Players

Governments;

Bonds longer;

Pseudo-government issuers;

Non-financial corporations;

Pension funds;

Bond index renames;

Insurers;

Exchange Traded Funds;

Mutual funds;

Hedge funds;

Commercial banks;

Mortgage lenders;

Central banks;

Private investors;

Summary;

Chapter 8: People

Introduction;

Proprietary traders;

The Volcker Rule;

Market makers;

Brokers;

Salespeople;

Researchers;

Back office and middle office;

Investment bankers;

Summary;

Chapter 9: Price action

Why do prices move?;

Prohibited by Dodd-Frank;

Necessity never made a good bargain;

Stability and leverage;

Fixed-income prices;

A stylised crash in fixed income;

Forwards, zeros and par yields;

Trading the crash;

Market irrationality;

Summary;

Part 2: More detail

Chapter 10: Swaps revisited

Introduction;

Credit risk in swaps;

Reducing the credit risk;

Other Clearing Services;

Cross-currency basis swaps;

The price of a basis swap;

A cross-currency issue;

Reducing credit risk in basis swaps;

Forward rate agreements;

Summary;

Chapter 11: Non-government issuance

Introduction;

Bringing a deal to market;

The syndicate;

Book-building: taking orders;

Pricing a swapped deal;

Pricing an unswapped deal;

Some legal details;

Free to trade;

An example issue;

Opportunistic reopenings;

Summary;

Chapter 12: Yield, duration, repo and forward bond prices

Measuring risk;

Yields: compounding frequencies;

Duration continued;

Definition of DV01;

How coupon affects duration and DV01;

An example yield curve;

A 3s10s flattener;

A flattener generates cash;

A forward flattener;

What happens if nothing happens?;

Weighting the forward flattener;

A barbell;

Carry and slide;

Summary;

Chapter 13: Bond futures

Introduction;

Specification;

Delivery day;

CBoT History;

The delivery process;

Cheapest to deliver: at par;

Cheapest to deliver: far from par;

CTD calculations before delivery;

Delivery tail;

Summary;

Chapter 14: Basic fixed-income arithmetic

The proportion of a year;

Act/360;

Yield to price and price to yield;

Semi to annual: halve and square;

Forward yield;

Forward asset swap;

Summary;

A company borrows some money from its bank for two years at an interest rate of 5%. This transaction contains interest-rate risk and credit risk. It might be that the bank is willing to hold one or both of these risks; or it might be that their nature or size prevents the bank from holding either. Financial markets allow the constituent risks in such a transaction to be priced independently, and for those risks to be recombined into forms for which a willing home can be found. Thus the financial markets allow borrowers to raise funds and investors to purchase assets. The various financial instruments enable investors, borrowers and intermediaries to price and transfer different combinations of risk.

During my eight years as an analyst in the financial markets, other researchers and I taught many new colleagues about finance. Pricing Money has grown out of those lectures and tutorials, and describes the basics of the trading of interest rates, including deposits, bonds, futures, swaps, options and foreign exchange. In general, these instruments are well designed for their tasks, and this book emphasises the purpose of each of their features.

Pricing Money should be read by those starting employment in finance, and by those hoping to be employed in finance — consider reading it before rather than after the interview. It will also be useful to those employed in non-financial roles within financial institutions, such as computer programmers, accountants, lawyers, and also to civil servants, corporate treasurers and the interested layman. However, it is a beginner’s book, with few equations, and avoids encyclopedic listings of every detail. Rather, it gives context to those lists that can be found elsewhere. Some of my proof-readers have even said that they want a copy for their spouse: ‘Had a nice day dear? Doing what?’ to which the answer should be ‘This’.

Pricing Money is divided into two parts. Part 1 is a beginner’s toolkit, containing a summary of the basics of interest rate trading: what is traded, who trades it and why. Part 2 goes into more detail and assumes proficiency with Part 1.

J. D. A. Wiseman

London, April 2001

www.jdawiseman.com

Part 1

A Beginner’s Toolkit

Let us say the publisher of this book owes me, the author, royalties of £100. The publisher sends me a cheque (a check in the US) for £100. But a cheque is not money; a cheque merely instructs a bank to pay. The publisher banks with NatWest, a large UK high-street (commercial) bank, and it is on this bank that the cheque is drawn. I pay the cheque into my account at HSBC. My publisher’s account at NatWest is lowered by £100, and my account at HSBC is increased by £100. But how does NatWest pay HSBC?

Both NatWest and HSBC have accounts at the Bank of England (BoE). HSBC is owed £100 by NatWest, and requests payment; in response NatWest sends a payment instruction to the BoE. This instruction causes NatWest’s account at the BoE to be lowered by £100, and that of HSBC to be increased by £100. One bank has paid the other; the whole transaction is now complete.

This money on account at the central bank is real money; the other versions are merely promises to pay real money. For most purposes we talk loosely of cash or money, but when the distinction is important we refer to central-bank money. True money, more properly called final money, can take one of only two forms: physical cash, which is rarely used in wholesale financial markets, and central-bank money. Money on account with a commercial bank is not final money; it is merely a promise to pay.

Although the above example described a small payment, the mechanics described are actually more typical of a large payment. Small payments tend to be batched together and netted, so that if HSBC and NatWest each owe the other, only the difference is transmitted. High-street banks, always keen to reduce their costs, care greatly about the detailed mechanics of small payments, but as this book is about the wholesale financial markets, we leave these details unstated.

Exactly the same principle applies in currencies other than British pounds, but in some there are minor complications. The US central bank, the Federal Reserve System (the Fed), is divided into a number of regional reserve banks; money at any of these regional reserve banks is final money. In general, most banks use an account at the Federal Reserve Bank of New York to settle US dollar activity in the wholesale financial markets. The European Central Bank (ECB) is part of the European System of Central Banks, which includes the Bundesbank (Germany’s national central bank), the Banque de France, the Banca d’Italia, and others. Money at any one of the eurozone’s National Central Banks (NCBs) is final money. But these are merely details.

In summary the legal definition of money is money on account at the central bank. Any other form of money is really just a promise to pay central-bank money.

To avoid the difficulties of multiple but linked central banks, we return to the example in sterling (a synonym for British pounds), but now assume that the payment was for £100 million. NatWest has reduced its client’s account by £100 million, and instructed the BoE to pay the same sum from its account to that of HSBC, and when the confirmation arrives, HSBC increases its client’s account by the same amount.

That done, NatWest has £100 million less than it did in its account at the BoE, and HSBC has the same amount more. NatWest now needs to find £100 million, and HSBC has £100 million that is surplus to its immediate requirements. A natural course of action would be for HSBC to lend NatWest the money at an interest rate agreed between the two.

Thus the key purpose of an inter-bank deposit market, a money market, is to offset the payment system. When customers pay money into their accounts, the bank will want a return on that money. To get that return it will lend the money to other customers or to other banks. And hence, in every currency of relevance to financial markets, banks lend money to each other.

CHF DEPOSITS O/N 2.60-3.10 T/N 2.83-3.08 S/N 2.83-3.08 1/W 2.88-3.13 2/W 2.88-3.13 1/M 3.27-3.42 2/M 3.28-3.43 3/M 3.30-3.45 6/M 3.38-3.53 9/M 3.42-3.57 12/ 3.50-3.65

When one bank lends another money, it will be at an agreed interest rate, and for repayment on an agreed maturity. Typical maturities for inter-bank money range from 1 day for overnight money to 6 months, and even out to 1 year, though with much less active trading in the longer maturities. The money market is so important that many banks maintain screens showing the latest prices at which they are willing to borrow and lend. The figure shows a copy of prices for Swiss-franc deposits, as published by Credit Suisse First Boston (CSFB), a large Swiss investment bank, late in the morning of 30 November 2000. At this time CSFB was willing to accept 3-month Swiss-franc deposits at a rate of 3.30%, and to lend Swiss francs to other high-quality banks for the same period at a rate of 3.45%. CSFB was making a market in these deposits, bidding for 3-month funds at 3.30%, and offering 3-month funds at 3.45%. The intention of such market-making is to borrow some at 3.30%, lend some at 3.45%, and keep the 0.15% difference, the bid-offer spread, as profit.

Let us say that Goldman Sachs, an American investment bank, needs to borrow Swiss francs for 6 months. One course of action would be for Goldman Sachs to borrow them for 6 months from CSFB at the screen price of 3.53%.

But there are alternatives. For example, Goldman Sachs could borrow the money for only 3 months (at the rate of 3.45%), and after 3 months reborrow the money. Why do this? To have the same cost as a 6-month loan, the reborrowing would have to be at 3.58%. This should make intuitive sense; 3.53%, the 6-month rate, is close to the average of 3.45% and 3.58%, the rates for the first and second 3-month periods.

So, if Goldman Sachs thinks that in 3 months’ time the cost of 3-month money will be less than 3.58%, then it would be cheaper overall for Goldman Sachs to borrow now for 3 months at 3.45%, and then in 3 months to reborrow at the rate then prevailing. Of course, if Goldman Sachs thinks that in 3 months’ time the cost of borrowing Swiss francs for 3 months is likely to be higher than 3.58%, it should borrow for the entire 6-month period now.

So the breakeven cost of 3-month money in 3 months’ time is 3.58%. This is said to be the forward price. The current price, also known as the spot price, of 3-month money is 3.45%; the 3-month forward price of 3-month money is +0.13% over spot. Market prices are implying that Swiss short-term interest rates are rising.

Goldman Sachs has more choices. If it believes that rates are unlikely to rise, then it might be cheapest to borrow for 1 day, and reborrow the money each subsequent day. Or if it thinks that rates are about to rise to very high levels, perhaps the best course would be to borrow money for 1 year (at 3.65%), and in 6 months’ time to lend these Swiss francs at the then-prevailing rate, hopefully much higher. No matter which view it takes, by choosing to borrow money at one maturity rather than another, Goldman Sachs is implicitly expressing an opinion on the future path of short-term rates. That opinion is measured—and can only be measured—against the current forward prices.

Exactly the same reasoning applies to an industrial corporation that needs to borrow Swiss francs for 6 months. It cannot avoid some form of implicit speculation; by choosing to borrow at one maturity rather than another, it is taking a view on the future path of interest rates, and that view should be measured against the market’s forward prices.

Let us return to our example, in which HSBC has lent NatWest £100 million, for let us say 3 months. After 3 months, NatWest returns the £100 million with interest. But what would happen if NatWest were to become bankrupt? Of course, the insolvency of a major high-street British bank is very unlikely; but it is not impossible. In this unlikely event, HSBC would lose its £100 million.

This insolvency risk, also known as credit risk or default risk, is very important. Banks deal not only with each other, and not only with top-quality financial institutions from countries with honest and competent financial supervision, but also with riskier entities (people, companies, or even governments). With some of these entities the risk of insolvency is significant.

The solution is called repo. Just as before, the bank lends its client the money. Also, the client lends the bank government bonds (described in Chapter 2) of the same value and over the same period of time. If the bank were lending £100 million cash for 3 months to a client, the client would lend £100 million worth of government bonds for the same period of time. The loan is said to be collateralised, and the government bonds are the collateral.

Under normal circumstances, after 3 months the client returns the £100 million plus interest, and the bank returns the bonds. But if the client should become insolvent and be unable to pay the money, the bank can recover its loss by selling the collateral that it holds.

For the bank that is lending money, the advantage of collateralisation is that it almost eliminates the credit risk. For the borrower of money, the disadvantage is that collateral must be found. The borrower’s disadvantage and the lender’s advantage are reflected in the price; the interest rate on a collateralised loan is below that on a non-collateralised loan. The precise gap varies across currencies, and within a currency it varies across maturities and according to the quality of the collateral and the counterparty, but a typical unsecured-secured differential is 0.1% to 0.5%.

It might help the reader to liken a repo to a residential mortgage. In both cases the cost of borrowing is cheapened by giving collateral to the lender. In one case the collateral is a financial asset, in the other the legal rights to a property. Of course, a mortgage can only be used to borrow money if one has a property, or is going to use the money to buy a property. Likewise, repo can only be used to cheapen the cost of borrowing for those who own suitable collateral, or who are going to use the money to buy that collateral.

In this example the collateral used was a government bond. By turnover and volume outstanding, this is the most common form of repo. But the parties may well agree to use other collateral, and there is a repo market in corporate bonds and other financial assets. The origin of the term ‘repo’ is a contraction of the word ‘repurchase’. In a repurchase agreement, a borrower of money would sell some financial asset to the lender of money, and at the same time agree to a later repurchase of that asset. The effect was that of a collateralised loan, with the interest rate being a function of the ratio of the sale and repurchase prices. This sale and repurchase is no longer the usual way to trade repo; the modern repo legal agreement more robustly manages a default by either side.

So in summary a repo is just a collateralised deposit. The collateral increases the creditworthiness and hence reduces the interest rate on the deposit.

The news services give the impression that central banks decide interest rates. For example, they might report that the Federal Reserve raised the interest rate from 6% to 6.50%, or that the European Central Bank raised rates by a quarter percent to 4.25%, or that the Bank of England left rates unchanged at 6%.

But we have just seen that banks lend money to each other at rates chosen by the market. There is no seeking of permission from a central bank: if Goldman Sachs is willing to lend 1-month US dollars at 6.2%, and CSFB is willing to borrow, then they trade. So what does the official interest rate mean, and how do central banks implement it?

Recall that many commercial banks have accounts with the central bank. These accounts are subject to rules about overdrafts, each central bank having its own rules. Some central banks prohibit overdrafts; at the end of each day no account may be overdrawn. Other central banks are less strict, specifying that every account must have a positive balance on average, where the averaging is conducted over a period of time known as a reserve period.

Whichever the case, commercial banks need to avoid having an overdraft at the central bank, either on average or every day. So what can an overdrawn bank do? It can borrow money from another bank. But this only works if, between them, the banks have enough. If their balances total an overdrawn state, then borrowing money from each other only passes the overdraft around. Bank-to-bank borrowing can only move rather than extinguish the overdraft. The escape is to borrow money directly from the central bank. And the rate at which the central bank lends money can indeed be chosen by the central bank; this is the rate that makes the headlines.

In their money-market operations, almost all central banks lend money against collateral; they use repo rather than accept the credit risk of unsecured lending. For some the only eligible collateral in this repo operation is the debt of the local government; others accept almost anything. The remaining details of the intervention also vary considerably from central bank to central bank: some intervene every day, others once a week; some lend money overnight, others for weeks at a time.

Some central banks occasionally use a form of auction to choose the rate at which funds are lent to the market. This is known as a floating or variable policy rate, but even when this is used the central bank sometimes determines the outcome in advance by specifying that bids below a certain cutoff will not be accepted. Whatever the detail of the central bank’s money-market operations, the commercial banks are obliged to turn to the central bank to clear their overdrafts. Thus central banks have great control over short-term interest rates.

This summary of the history of Regulation Q was wrong. Not importantly wrong, but nonetheless, wrong. The following quotations come from Requiem for Regulation Q: What It Did and Why It Passed Away, February 1986, R. Anton Gilbert of the Federal Reserve Bank of St. Louis.

The Banking Acts of 1933 and 1935 … authorized the Federal Reserve to set interest rate ceilings on time and savings deposits paid by commercial banks. [p22]

From the mid-1930s to the mid-1960s, the ceiling rates … generally were above market interest rates. [p26]

Regulation Q policy was changed in 1966, …. In contrast to the earlier period …, 1966 began a period of ceiling rates on at least some categories of time and savings deposits at commercial banks that were kept below Treasury bill rates. [p26]

March 1986 marked the end of the phase-out of interest rate ceilings on deposits. [p22]

— JDAW, July 2021;

link updated May 2025.

Bloomberg Opinion had a rare discussion about Regulation Q, Banking Is Heading Back to the Days of Free Toasters, 4 May 2023, by Stephen Mihm.

— JDAW, May 2023.

One might expect that a currency’s money market would be based in that currency’s financial capital: US dollars in New York, sterling in London, yen in Tokyo, Swiss francs in Zurich, etc. This was so until the late 1950s, when the Soviet Union, concerned that its dollar deposits in New York might be frozen by the US government, opened a dollar account with a European bank. Then in 1963 the US introduced Regulation Q, which imposed a maximum rate of interest that could be paid on domestic dollar deposits, and in 1965 introduced a lending tax.

The upshot of this regulation was that banks benefited from doing business outside the reach of US law, and London came to dominate this offshore dollar business. Accounts ‘in London’ are subject to the law of England and Wales, so US sanctions, restrictions and taxes cannot apply. In time the banks in London, often branches of US banks, started actively trading deposits in other currencies as well.

Nowadays regulation is lighter, and so money can be moved cheaply to and from London; therefore the price of London money generally tracks very closely that of domestic money. But there have been differences between domestic and London interest rates. These differences have had different causes at different times: tax laws, bank regulations, the possibility that a country might introduce exchange controls, and the differences between the creditworthiness of the banks in London and those in the domestic market.

The London money market is particularly active in dollars, sterling, euros, yen, and Swiss francs, with less liquidity (ease of trading in large size) in Australian, Canadian and New Zealand dollars. Deposits in most other currencies trade only in their domestic market.

The terminology for London money is confusing. When dollar deposits started to trade in London, they were called eurodollars, the ‘euro’ prefix then meaning that the currency was outside its home jurisdiction. And hence euromarks for London-traded Deutschmarks, eurolira for Italian lira in London, euroyen, euro-swiss, and so on. The use of the ‘euro’ terminology subsequently became more widespread. Much corporate debt (discussed in more detail later) is issued under the law of England and Wales, even if the currency is that of the US, Germany or Switzerland. Thus tradable debt (bonds) issued in London became known as eurobonds.

Now fast-forward to 1999, the start of Europe’s single currency, called the euro. The words ‘eurodollar’ and ‘euroswiss’ become ambiguous. They still refer to London-delivery dollars and Swiss, but now they can also mean exchange rates between euros and US dollars and between euros and Swiss francs. On rare occasions one even hears the term ‘euroeuro’ for London-delivery euros. So the word ‘euro’ needs to be interpreted with care.

Several European countries, including Germany, the Netherlands, France, Italy and Spain, are members of EMU, Europe’s Economic and Monetary Union. These countries share a common currency called the euro, their former national currencies having been merged together. This irrevocable merger was achieved by legal diktat, and now, in law, each of the former national currencies is a denomination of the euro.

Only | Sackcloth and ashes: |

There are 100 cents in the US dollar. US law is clear: if you are owed 100¢, then you are owed $1. This 100-to-1 ‘exchange rate’ is irrevocable; it cannot be changed. Indeed, if you deposit in your bank account 1000¢, and then deposit $10, the bank does not keep a separate tally of how many dollars and how many cents have been deposited, it only knows that the account contains $20.

Under European law, and the law of the countries of the EU, the euro is no different. It too comes in various denominations, including the euro cent (at an exchange rate of 100 to 1), the Deutschmark (at an exchange rate of 1.95583 to 1), the Dutch guilder (2.20371 to 1), the French franc (6.55957 to 1), etc. Legally, the Deutschmark exists as a currency in the same sense that the US cent exists: the Deutschmark is a denomination of a primary currency, the euro, albeit a non-decimal denomination.

Note that US dollars and US cents have different physical manifestations, the former on paper printed green on white, the latter as metal coins. This makes no difference; they are still the same currency. Likewise, the Deutschmark and the French franc have different physical forms—but this too is irrelevant, because they are both denominations of the euro.

Banks quote the same interest rate for deposits in dollars and deposits in cents, because they are the same currency. Likewise, it must be the same interest rate for deposits in euros, Deutschmarks, Dutch guilders, French francs and the former national currencies of the other EMU members, because they are all the same currency. And because these are all the same currency, wholesale financial markets quote prices in euro, not in the former national currencies.

| Code | Currency |

|---|---|

| USD | US dollar |

| EUR | Euro |

| JPY | Japanese yen |

| GBP | UK pound (sterling) |

| CHF | Swiss franc |

| CAD | Canadian dollar |

| AUD | Australian dollar |

| NZD | New Zealand dollar |

| MXN | Mexican, new peso |

| SEK | Swedish krone |

| DKK | Danish krone |

| NOK | Norwegian krone |

| PLN | Polish, new zloty |

| HUF | Hungarian forint |

| CZK | Czech krone |

| ZAR | South African rand |

| SGD | Singapore dollar |

| RUB | Russian, new rouble |

Former national currencies now absorbed into the euro | |

| DEM | German mark |

| NLG | Dutch guilder, florin |

| FRF | French franc |

| ITL | Italian lira |

| ESP | Spanish peseta |

Codes beginning with X have special meanings | |

| XEU | ECU, now the euro |

| XAU | Gold |

| XAG | Silver |

Having discussed the ambiguities in the word ‘euro’, it is worth mentioning other possible sources of ambiguity in the writing of money. One might think that ‘$100m’ means one hundred million dollars. But the ‘m’ is ambiguous. In English ‘m’ means a million, in French it is the abbreviation for ‘mille’, meaning a thousand (though the abbreviation is more usually written in uppercase). A French speaker would write one hundred million as 100MM, and could well read 100m as one hundred thousand. And the dollars are ambiguous; they could be from any one of a number of countries, including the US, Canada, Australia, New Zealand and Singapore.

To avoid ambiguity in currency names, international standard ISO 4217 specifies official currency abbreviations. Each of these abbreviations has 3 letters: in most cases the first two letters identify the country, the third the currency. Codes for the most important currencies are shown in the table overleaf. Henceforth it will be assumed that readers are comfortable with the first seven in this list: USD, EUR, JPY, GBP, CHF, CAD and AUD, and at least approximately with their current values.

Money amounts should be written unambiguously: USD 100 million and USD 100,000,000 are both clear. Unless the context is clear and not legally binding, readers are advised to avoid use of the suffix ‘m’.

The word ‘billion’ used to be ambiguous. In American English a billion is a thousand million; in old British English it used to mean a million million and it still does in some other languages. But in English the Americans have won: a billion is always a thousand million, and a trillion is always a million million. Because the words ‘million’ and ‘billion’ sound so similar, in spoken English the word ‘yard’ (a contraction of ‘milliard’) is often used as a synonym for a thousand million.

Care should also be taken when writing and reading dates. In America ‘03/10/08’ is March 10, 2008; in most of the rest of the world it is 03 October 2008.

There is a detail about money markets that will prove important later. In most currencies the money market is said to be ‘T+2’. This means that settlement, when delivery of funds takes place, occurs 2 business days after the trade date (the ‘T’ in ‘T+2’). The settlement date is also known as the value date.

So if on Monday 13 August 2007 J. P. Morgan agrees to lend USD to CSFB for 3 months, J. P. Morgan would pay this money to CSFB two days after trading, on 15 August, and it would be returned with interest 3 months after that, on 15 November 2007. Most currencies’ money markets are T+2, including USD, EUR, JPY and CHF. The main exception to T+2 is sterling, which is T+0, also known as same-day settlement. In sterling, standard practice is to settle a trade on the same day that it is agreed. However, counterparties can always agree to a non-standard settlement, but in the absence of such agreement, GBP is T+0 and almost all others are T+2.

The trading timetable for deposits

There is a standard definition of the seemingly simple phrase ‘3 months’. For example, when is 3 months after 30 November 2009? It can’t be 30 February 2010, because there isn’t such a day. And it can’t even be 28 February 2010, because that is a Sunday. As it is, the official definition from the International Swap Dealers Association (ISDA) says that 3 months after Monday 30 November 2009 is Friday 26 February 2010, but the point is that there is a precise definition.

Payments in the real economy cause banks’ balances with the central bank to rise and fall. A bank with a shortfall will want to borrow it from a bank with an excess, and hence there is an inter-bank deposit market (a money market).

This market exists, with maturities from 1 day to 1 year, in every currency, and in the major currencies it exists both domestically and in London.

A market participant, by choosing to borrow or lend money at any particular maturity, is implicitly speculating against the forward rates implied by the spot rates.

Banks also lend money against collateral; the secured nature of this lending reduces the credit risk, and hence it reduces the interest rate.

Central banks have great control over short-term interest rates.

The euro is a legal construct that makes the former national currency units irrelevant to wholesale financial markets.

The oldest wholesale financial market is in government debt. Governments have always found it more difficult to tax than to spend—on the pleasures of the court, fighting wars, welfare, or even just repaying the previous borrowing. So governments borrow money, and they have found that the cheapest way to do this is to issue tradable government debt.

Let us move to an example. At the start of 2000, the German government auctioned a new bond, the euro-denominated 6.25% of 04 January 2030. Owners of €100 nominal, also called face value or notional, of this bond receive a coupon of €6.25 on every 04 January until and including 04 January 2030, when holders also receive the principal of €100.

Note that the payments to a holder are defined per nominal. To repeat: €100 nominal of this bond pays a coupon of €6.25 every 04 January, and also a principal of €100 at maturity. That does not mean the market price of this bundle of payments is €100. If the market deems 6.25% to be a generous coupon, this bond will cost more than €100. And if the market deems 6.25% to be miserly, the bond will cost less. The nominal amount simply defines the payments.

In January 2000 the German government sold €5 billion nominal of this bond by auction. The market thought that 6.25% was slightly generous, so was willing to pay slightly more than €100 per €100 nominal: the auction price was slightly over par, i.e. slightly over 100. In this manner the German government borrowed just over €5.02 billion from the financial markets, money which it could then spend immediately.

It may be helpful to imagine a bearer bond, that is, a bond in paper form rather than electronic form. A bearer bond is marked with the face value in large type, say 100, in some particular currency. Coupons are attached down the side, and these are marked with their value, here 6.25, and their payment date. On a coupon day the holder presents the bond to the issuer or its agent, the appropriate coupon is cut off (the word ‘coupon’ being derived from the French verb couper ‘to cut’) and 6.25 paid to the holder. So for any particular face value the size of the payments is fixed—it’s printed on the bond certificate. However, although the payments are fixed, the bond itself might have a market price above or below the face value, and this market price can fluctuate.

So, a government bond pays a series of cashflows, in the form of interest coupons and a final principal. The sizes of these payments are known in advance. A bond is just a tradable promise to pay a bundle of future cashflows. These tradable bundles are almost synonymously known as bonds, securities, notes, paper and debt.

For ease of analysis, let us start by considering the simplest type of tradable government debt. Many governments sell a particular type of short-term debt that pays a single cashflow of 100 at maturity—only the principal is paid, no coupons. This type of debt is called a Treasury bill, usually abbreviated to T-bill.

So let us consider a T-bill that matures in 1 year. If this costs 100 then the purchaser in effect receives no interest (lends 100 now, repaid 100 at maturity, implies an interest rate of 0%). If this 1-year T-bill costs 99 (lends 99 now, repaid 100 at maturity), the purchaser is in effect being paid an interest rate of about 1%. And if it costs 95, the purchaser is in effect being paid an interest rate of a little over 5%. This effective interest rate is called the yield. Observe that a lower price means a higher yield, and a higher price means a lower yield. This is crucial:

Price up = yield down;

Price down = yield up.

We now emphasise this rule with a series of examples. In each example let us consider a coupon-paying bond with a nominal coupon of 6%, so the interest payments are 6 currency units per year. For example, a 3-year bond with an annual coupon of 6% pays 6 currency units at the end of year 1, the same again at the end of year 2, and 106 when it matures at the end of year 3. This stream of cashflows is fixed when the bond is created, and does not depend on the price of the bond. Whether the bond costs 90 or 110, the size and timing of these cashflows are fixed, which is why bonds are known as fixed-income investments.

Let us consider a 1-year bond paying this coupon of 6%. We are therefore considering a bond that has a single payment of 106 at the end of year 1. If a bond that pays 106 in 1 year costs 100, then the purchaser is receiving an effective interest rate (a yield) of 6%. This relationship can be turned round: if this cashflow (106 in 1 year) costs a price that implies a yield of 6%, then that price must be 100. Therefore, for a bond with this cashflow (106 in 1 year), saying that it costs 100 is equivalent to saying that it yields 6%. More generally, for any given bond, for any set of known fixed cashflows, a price implies a yield and a yield implies a price.

At what price would this 1-year 6% bond yield 5%? If the yield is 5% then 100 currency units today are worth the same as 105 units in 1 year:

100 today = 105 in 1 year

Dividing by 100 gives that

1 today = 1.05 in 1 year

dividing by 1.05 gives that

1 ÷ 1.05 today = 1 in 1 year

and multiplying by 106, we conclude that

106 ÷ 1.05 today = 106 in 1 year

Thus, at a 5% yield, 106 in 1 year (which is what the bond pays) is worth 106 ÷ 1.05 ≈ 100.95 today. And hence saying that this bond costs 100.95 is equivalent to saying that it yields 5%. Note again that a higher price is equivalent to a lower yield. And if the same bond is priced to yield 7%, then it must cost 106 ÷ 1.07 ≈ 99.07. Again, yield up implies price down.

What about a 2-year bond? Well, 100 nominal of a 2-year bond with a 6% annual coupon pays 6 currency units after 1 year and 106 after 2 years. Clearly, if the yield is 5% then

6 ÷ 1.05 today = 6 in 1 year

So the first payment on the two-year bond is 6, and today that is worth 6 ÷ 1.05. What about the second payment? We know that

1 today = 1.05 in 1 year

and likewise that

1 in 1 year = 1.05 in 2 years

So

1 today = 1.05 × 1.05 in 2 years

This is just compound interest; assuming a 5% yield, 1 unit today is worth the same as 1.05 in a year is worth the same as 1.05² = 1.1025 in 2 years. Thus the second payment, of 106 in 2 years’ time, is worth 106 ÷ 1.1025. The two payments together are therefore worth (6 ÷ 1.05) + (106 ÷ 1.05²) ≈ 101.86.

Observe that a 6% 1-year bond and a 6% 2-year bond each cost exactly 100 when yielding 6%. And that the yield falling to 5% is equivalent to the price increasing by 0.95 for the 1-year bond, but increasing by 1.86 for the 2-year bond. This illustrates a general rule: longer bonds are more sensitive to changes in yield. So for any given change in interest rates, a longer bond’s price will change by more than a shorter bond’s price.

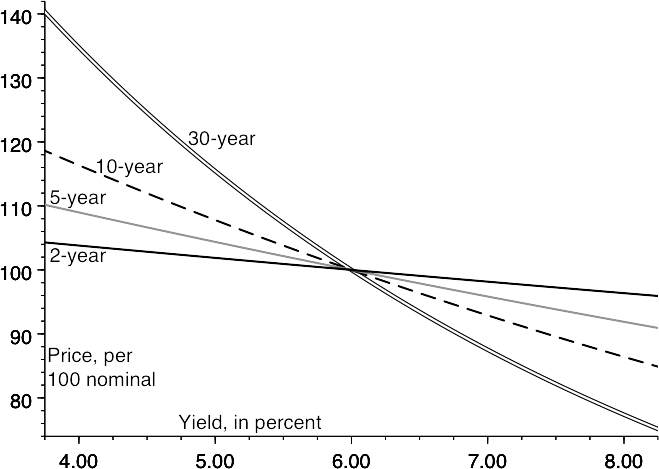

The effect of this rule can be seen in the table and the chart overleaf, which show the prices of 6% bonds of various maturities at various different yields. Observe that a higher yield means a lower price, and that the longer-dated securities move further in price for any given change in yield.

Prices of bonds with a 6% nominal coupon

| Maturity (years) | 4% | 5% | Yield 6% | 7% | 8% |

|---|---|---|---|---|---|

| 1 | 101.92 | 100.95 | 100.00 | 99.07 | 98.15 |

| 2 | 103.77 | 101.86 | 100.00 | 98.19 | 96.43 |

| 5 | 108.90 | 104.33 | 100.00 | 95.90 | 92.01 |

| 10 | 116.22 | 107.72 | 100.00 | 92.98 | 86.58 |

| 30 | 134.58 | 115.37 | 100.00 | 87.59 | 77.48 |

Price-yield relationships for bonds of various maturities

Once again, let us restate the difference between coupon and yield:

The coupon of a bond defines the payments made. The coupon is known when the bond is first issued, and remains constant until maturity. The bond’s coupon is not altered by a change in the bond’s price.

The yield is the effective interest rate, calculated from the price of the bond. The market determines the price, and hence the yield. As time passes, or as the price changes, the yield also changes.

In other words, coupon is the interest rate paid per 100 nominal of the bond; yield is the effective interest rate paid per 100 cost.

In Chapter 1 we saw that deposits of different maturities have different interest rates. The same is true of government bonds: different government bonds have different yields. The prices of deposits of different terms are driven by the prospects for the path of interest rates in the future, and exactly the same principle applies to government bonds. If the market believes that interest rates are rising over the long term, longer-dated bonds will yield more than shorter-dated bonds. In this case the yield curve would be described as positive, or upward-sloping.

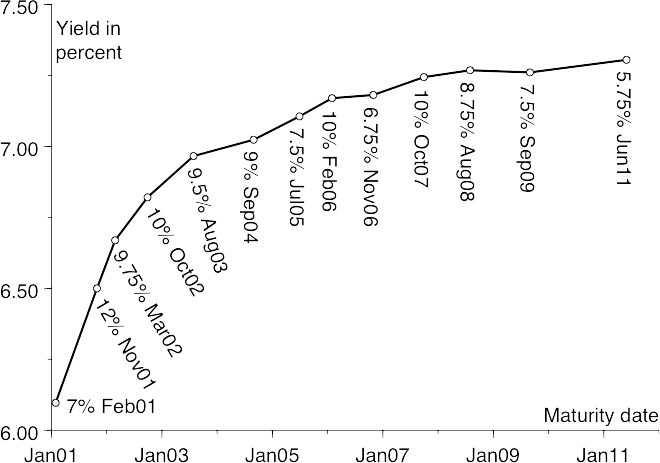

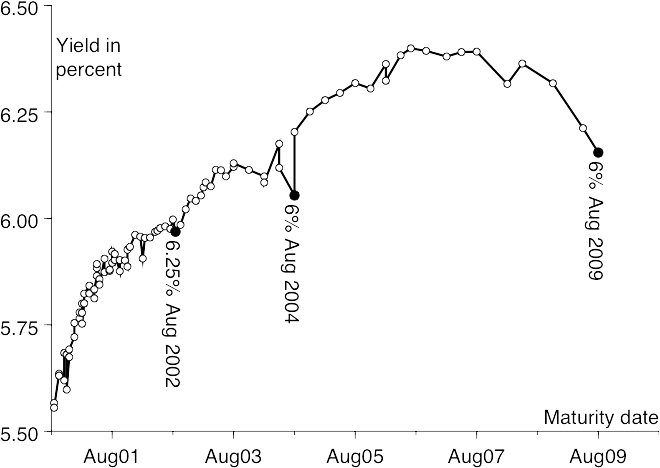

The following chart shows yields of various bonds issued by the government of the Australian Commonwealth, as of 21 January 2000. Maturity is plotted on the x‑axis and yield on the y‑axis. Bonds of different maturities have different yields.

Yields of Australian Commonwealth government bonds as of 21 January 2000

On the chart the x‑axis is the maturity date, because that’s easy and intuitive to understand.

Those of a technical disposition might be interested in ‘On The Plotting of Yields’ which explains the mathematically natural choice of x‑axis.

— JDAW, November 2019.

2001 wording: ‘twos-tens are plus sixteen’. But in 2019 I’d say ‘twos-tens is plus sixteen’. My best guess is that this was a writing error in 2001, perhaps caused by auto-correct; but it could be that usage has shifted since then; and it could be that usage hasn’t but I have.

— JDAW, December 2019.

The steepness of the yield curve is usually quoted in hundredths of a percent, called basis points and abbreviated to ‘bp’. So ‘2s10s are +16bp’, read as ‘twos-tens are plus sixteen’, means that the government bond with 10 years to maturity (or the one nearest to 10 years) yields 0.16% more than the government bond with 2 years to maturity (or the one nearest to 2 years). The steepness of the yield curve is actively traded; this is discussed in Chapter 12.

Most governments appoint dealers in their bonds. Bonds are sold at auction, and typically only these primary dealers are allowed to bid. In return for this privilege, the primary dealers are obliged to make markets in that government’s debt; dealers must quote prices to clients.

This is an obligation; dealers must make markets in conditions fair and foul. However, the precise nature of this obligation varies from government to government. Some only require that primary dealers stand ready to make a two-way price (i.e. a buying price and a slightly higher selling price) to customers on demand. Others insist that real-time live prices be made continuously on an electronic dealing system.

Whatever the detailed obligations, an investor wanting to sell or to buy, or to switch between different securities, would usually ask a price from a primary dealer, or from a small number of primary dealers.

The governments of most developed countries have issued debt, and many still do so. This tradable government debt currently has a total value of over $5 trillion.

US government bonds are issued by the Treasury Department and are called Treasuries. As of late 2000 the total value of outstanding Treasuries was almost $1.9 trillion. US Treasuries (USTs) pay coupons semi-annually, so $100 nominal of the 8% Treasury of 15 Nov 2021 pays coupons of $4 every 15 May and 15 November. US government securities with an initial maturity of 10 years or less are called Notes, those with an initial maturity of more than 10 years are called Bonds; both are known as Treasuries or USTs. The prices of USTs are quoted in thirty-secondths rather than in decimal. And hence a price of 98‑28 means 98 28⁄32 = 98.875. A ‘+’ indicates half a 1⁄32, so 99‑24+ is 99 + 24⁄32 + 1⁄64 = 99.765625. The US is the only country still quoting the price of its debt in these fractions.

British government debt used to be issued in the form of paper securities that had a gilt edge, and they are still called gilt-edged securities, or gilts for short. Gilts date back to the founding of the Bank of England in 1694, and like USTs have semi-annual coupons. Outstanding gilts total about £300 billion.

Rightly, the Agence France Trésor has unified the naming of its securities. All the bonds are OATs, the last BTAN being the 1% July 2017 issued in 2012. But Germany still has three names, and the US has both Bonds and Notes.

— JDAW, March 2021.

All the large eurozone governments have issued fixed-coupon bonds. Those of Germany and France total about €600 billion and €500 billion respectively, and they pay annual coupons. As in the US, the name of the debt depends on the initial maturity. German paper is issued with one of 2, 5, 10 or 30 years to maturity. The 2-year paper is called Schätze (a contraction of a much longer German noun), the 5-year OBL, and the 10- and 30-year Bund. French government debt with 5 years or less at issue is called BTAN; debt with longer than 5 years at first issue is called OAT. The short names quoted here are used fluently by participants in these markets, but they do not affect the cashflows or the creditworthiness of the issuer. Tradable Italian government debt totals about €1 trillion, and exists in a number of different forms, the largest and most important of which is the fixed-coupon BTP.

The Japanese government bond (JGB) market has in recent years become huge (some ¥370 trillion), and is still growing at tens of trillions of yen per annum. It pays coupons semi-annually.

Repo was discussed in Chapter 1. When borrowing money, repo can be used to improve the credit quality of a loan and so reduce the interest rate. The cost of secured borrowing is typically about 10bp to 50bp less than that of unsecured borrowing, though the differential varies from currency to currency, from maturity to maturity, and over time.

But repo is not only a money-market instrument; it is also a bond-market instrument. Consider the position of a bond dealer who has sold a bond to an investor. If the dealer already owned that bond, then delivery is easy and the sale lightens the dealer’s inventory. But what if the dealer didn’t own the bond? To be able to deliver the bond to the investor, the dealer must borrow that bond. The dealer would borrow the bond from a third party, and lend money to that third party. This is a repo, and the interest rate paid on this cash deposit is the price of the repo.

In a typical government bond market, most bonds will not be in particular demand and will trade at the same repo rate. This rate is often called general collateral (GC). But if many market participants are trying to borrow a particular bond, the demand for that bond will be reflected in the price: the interest rate paid on the deposit will be low. A bond that is more in demand will have a lower repo rate and is said to be tight or special.

If a bond is special, a dealer can use that bond as collateral to borrow money cheaply, by lending the bond and borrowing money at a sub-GC rate. That access to cheap funding is a perk of owning the bond, and means this bond will tend to trade expensively relative to other non-special bonds of similar maturity. Hence there is a close relationship between repo and the relative cheapness or expensiveness of different government bonds.

It used to be that a bond cost the price that was quoted. If the quoted price was 102, the cost of the bond was 102, per 100 nominal, in the appropriate currency. This was a clear and easy way to do things. However, it did mean that bonds appeared to collapse in price when a coupon was paid. If a bond paid a coupon of 3 currency units, the quoted price would typically drop by about 3, as the coupon just paid fell out of the price. So the way that prices are quoted was changed.

Prices are now quoted clean, that is without accrued interest. If a bond is halfway through its coupon period, and the next coupon is to be 3, then the buyer pays 1.50 more than the quoted clean price. If the bond is two-thirds through its coupon period, the accrued interest is 2. If the bond is almost at the end of its coupon period, the accrued interest is almost 3; when the coupon is paid, the fall in the accrued interest (from just under 3 to zero) offsets the change in value. A bond’s value is its dirty price, which equals its clean price plus its accrued interest; this is also known as its present value or its cost.

This accrued interest can be thought of as reimbursement for the seller. If the seller has sold the bond two-thirds of the way through the coupon period, then the seller is, in some sense, entitled to two-thirds of the coupon. In some jurisdictions this entitlement to a proportion of the coupon, as reflected in the payment of accrued interest, has taxation consequences. However, bond trading is now much less tax-dependent than it was.

Note though that equities, known as shares in the UK and stocks in the US, are still quoted dirty; the equity price drops as a coupon is paid. Also, in the equity markets, a coupon is usually called a dividend and is not of fixed size.

A US government bond pays coupons every half-year until maturity, when the principal of $100 is also paid. But what if, for some particular need, an investor wishes to acquire a different shape of cashflows? For example, what if an investor wishes to put money away until 2021 and not receive any coupons before then? Or what if that investor wishes to receive coupons, and only coupons, from 2016 until 2021?

Because there is sometimes a demand for such customised collections of cashflows, the US government allows bonds to be stripped. This is an exchange facility; a dealer hands in a US Treasury and receives in return the same cashflows but in separately tradable form. These cashflows are called STRIPS, short for Separately Traded Registered Interest and Principal Securities.

Stripping breaks a bond into its individual cashflows. Stripping a bond exchanges it for its principal strip, also called its principal only (PO), and its coupon strips, also called interest strips or interest onlys (IOs). If the date is now summer 2002, stripping $100 million nominal of the US Treasury 8% Nov 2021 produces $4 million nominal of the Nov 2002 coupon strip, $4 million nominal of the May 2003 coupon strip, and the same amount of each coupon strip until 15 Nov 2021, as well $100 million nominal of the principal strip, dated 15 Nov 2021. Stripping the bond has therefore exchanged one bundle of cashflows (joined together in a single bond) for a bundle of the same cashflows (but in a separately tradable form).

Equally, it is possible to reconstitute a bond from its strips. If one hands over the principal strip and the correct amounts of the coupon strips, one receives the original bond in return.

There is a technical difference between coupon strips and principal strips. Principal strips come from a particular bond. One cannot reconstitute a bond using a same-maturity coupon strip instead of the principal strip, or by using a same-maturity principal strip from a different bond. In other words, the principal strips are marked with the name of the source bond; in order to reconstitute a bond, one needs a principal strip from that same bond.

But coupon strips are not marked with their source. Consider stripping the 8% Nov 2021 and selling some of the Nov 2005 strip. Later one could strip the May 2006 Treasury and use the resulting Nov 2005 coupon strip as part of the reconstitution of the 8% Nov 2021.

Several governments have a stripping facility. Almost all US Treasuries are strippable, but in practice the only USTs that are stripped are those that pay coupons on either 15 February and August or 15 May and November. France also has a strip market, though it is not as heavily traded as in the US. The UK strip market is less active than the French strip market, and there is even less activity in stripping German Bunds, Italian BTPs, Spanish Bonos, Dutch State Loans and Belgian OLOs.

A strip pays a single cashflow at maturity, and no intervening coupons. Bonds with this property are known as zero-coupon bonds. Because strips are zero-coupon, there is no accrued interest. For this reason, in some jurisdictions they are taxed differently to ordinary coupon-paying bonds.

All the examples above referred to government debt with fixed cashflows. Governments also issue other types of debt. Inflation-linked debt has cashflows that increase in line with retail consumer prices. The details differ from country to country, but the broad principle is the same. The payments made by the issuer to the holder are specified in real terms, that is, in money with constant purchasing power.

For example, inflation-linked British government bonds are called index-linked gilts (ILGs) and are described by the UK Debt Management Office as gilts on which both the [coupons] and the capital repayment on redemption are adjusted in line with inflation (as measured by the Retail Prices Index, or RPI). Investors are thus protected against the value of their investments being eroded by inflation.

So let us consider the last three cashflows of the 2½% inflation-linked gilt that matured on 24 September 2001. If this had been a conventional gilt, then the final two semi-annual coupons, paid in March and September 2001, would each have been £1.25, and the principal (paid on the same day as the final coupon) would have been £100. But the payments of an ILG are indexed to retail prices, which had more than doubled since the bond was first issued: the penultimate coupon was £2.7227, the final coupon was £2.7323 and the principal was £218.5846.

Conceptually it is useful to think of such a bond as being denominated in bread and beer, or some other real tangible thing, rather than in monetary units. Imagine buying a bond for 100 units of real goods, and that this bond pays the holder 3 units of these goods every year until maturity, when it pays 100 units. This investment would return 3% more than inflation. But to avoid the inconvenience of physically delivering a basket of goods, inflation-linked bonds pay the equivalent of this basket in cash. The payments on an inflation-linked bond are therefore real rather than nominal, and its yield is also quoted real. And hence a quoted yield of 3% means that the holder is in effect paid inflation plus 3%.

Various countries have issued inflation-linked debt: index-linked gilts by the UK since 1981; Real-Return Bonds (RRBs) by Canada since 1991; and Treasury Inflation-Protected Securities (TIPS) by the US since 1997. Australia, Sweden and France have also issued inflation-linked securities.

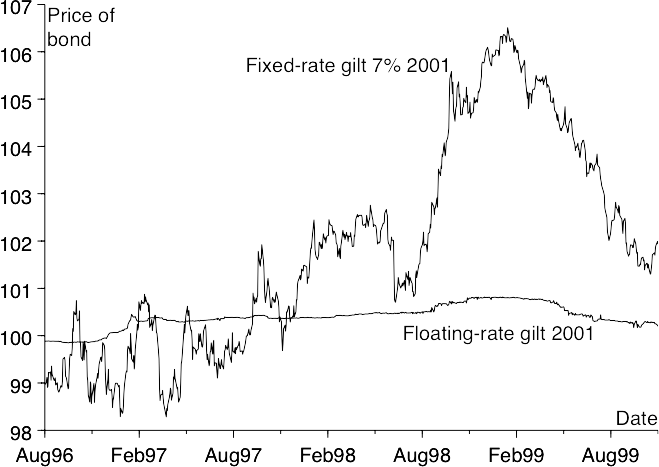

Some governments have issued floating-rate debt. Floating-rate notes (FRNs) pay a coupon that varies with short-term inter-bank interest rates. At the start of each coupon period, the level of inter-bank interest rates is noted. This level is the Lɪʙᴏʀ fixing (defined in Chapter 3) and it is used to calculate the coupon that is paid at the end of the period. Buying an FRN at 100 is therefore much like leaving the money on deposit at the bank at a floating rate. Of course, if the FRN is issued by the government, the credit is superior to that of a commercial bank, a fact reflected in the price. Very little floating-rate government debt is issued nowadays, but other entities, especially financial institutions, issue large quantities of FRNs.

So we have examined government debt and hinted at the existence of non-government debt. Actually, there is as much non-government tradable debt as government tradable debt. Indeed, for a small number of large investment banks, the issuance of non-government debt is a highly profitable business.

The key difference between government debt and non-government debt is the possibility of default. If a government is borrowing money in a currency over which it is sovereign, it can always print money to pay the bondholders. But if the money is being borrowed by a commercial bank or an industrial corporation, or even by a government issuing in a foreign currency, the bond-holder cannot be sure of being paid. A bondholder will require compensation for this risk of default, so the yield of a non-government bond will typically be higher than the yield of a government bond with similar cashflows.

The boundary between government and non-government debt is not entirely clear-cut. The governments of the eurozone are not individually sovereign over the euro, so any one of them could default (assuming that it was not rescued by the others). Indeed, when the UK has borrowed in euros, it has done so more cheaply than Italy, despite the fact that Italy is a eurozone government and the UK is not. Furthermore, the US, Japan and various European countries each have borrowers that are widely assumed to be guaranteed by the government, despite the absence of a formal written guarantee.

Whoever the issuer, a lender will typically want a higher return than on a domestic government bond with similar cashflows. How much higher depends primarily on the creditworthiness of the issuer, and when assessing the creditworthiness of a particular issuer, a buyer of debt will be strongly guided by the opinion of a rating agency.

Rating agencies publish their opinion of the creditworthiness of many borrowers and bonds. These opinions are known as credit ratings. The three most prominent rating agencies are Moody’s, Standard & Poor’s and Fitch. The table shows the long-term investment-grade senior ratings. For each agency the top rating is known as triple-A, with each of the lower ratings coming in three subcategories. Below the investment-grade ratings listed in the table come the speculative ratings of double-B and single-B, then the near-default C ratings and finally the in-default D ratings.

As a guide, a small number of government issuers are triple-A, including those of Switzerland, UK, US, Norway, Netherlands, Germany, France, Austria, and some minnows such as Liechtenstein. Also triple-A are most of the large supranational borrowers, including the International Bank for Reconstruction and Development (IBRD), more commonly known as the World Bank, the European Investment Bank (EIB) and the European Bank for Reconstruction and Development (EBRD). Triple-A borrowers can generally access funds at a rate cheaper than 1% to 2% over the local government.

| Moody’s | S&P | Fitch | Meaning |

|---|---|---|---|

| Aaa | AAA | AAA | Triple-A: highest quality |

| Aa1 | AA+ | AA+ | Double-A: very high credit quality, … very strong capacity for timely payment … not significantly vulnerable to foreseeable events |

| Aa2 | AA | AA | |

| Aa3 | AA− | AA− | |

| A1 | A+ | A+ | Single-A: high credit quality … strong capacity for timely payment … more vulnerable to changes in circumstances |

| A2 | A | A | |

| A3 | A− | A− | |

| Baa1 | BBB+ | BBB+ | Triple-B: good credit quality … adequate capacity for timely payment, but adverse changes in circumstances more likely to impair |

| Baa2 | BBB | BBB | |

| Baa3 | BBB− | BBB− |

Banks and other private sector financial institutions are typically double-A; a bank whose rating falls much below this will have difficulty borrowing money on economic terms in the inter-bank money market. Industrial companies span the whole range of ratings. Changes in ratings often cause changes in price, and hence many analysts are employed to predict these changes.

Governments borrow money, mostly by selling fixed-coupon bonds.

Price up = yield down; price down = yield up.

For any given change in yield, longer bonds change in price by more than shorter bonds.

Dealers borrow bonds using repo.

A dealer buying a bond may well borrow the money to do so, cheapening that borrowing using repo.

Some government bonds are strippable; they can be exchanged for the same bundle of cashflows in separately tradable form.

Entities other than governments also issue bonds, and the additional yield over the debt of the government is dependent on the credit rating.

Consider the position of an entrepreneur about to open a gold mine. This entrepreneur knows that gold can be extracted from the ground and purified for less than, say, $250 per troy ounce, including all costs. Gold is now trading at $275/oz, but it will take a while for the mine to be built and extraction to start. The problem is that the entrepreneur cannot know whether the price of gold will still be above $250/oz when it is available for sale.

So our entrepreneur wants to sell gold for delivery in 1 year, at a price agreed now. A dealer is asked to bid (to state a buying price) for gold, not for immediate (spot) delivery but for forward delivery in 1 year. A price is made: let us say that the dealer bids $280/oz. Recall from Chapter 1 that the forward price is not necessarily the same as the spot price.

But our entrepreneur is not yet in the clear. What if the price of gold collapses and the dealer goes bankrupt? The bankruptcy means that the contract, to sell a certain quantity of gold at $280/oz, is worthless. Instead the entrepreneur must take the low market price then prevailing. So this expert in gold mining must now become an expert in assessing credit risk.

It gets worse. Let us imagine that the agreed forward delivery was for any date in June. But later the miner realises that production is running two months behind schedule. The miner would now need to buy back the June-delivery gold that had previously been sold, and instead sell August-delivery gold. If the miner had sold June-delivery gold to a particular dealer, and later repurchased June-delivery gold from a different dealer, then the two contracts would not fully offset—there would be credit exposure to both dealers.

There is a better way, known as a futures contract. An exchange allows a number of futures contracts to be traded. Each contract is a contract to buy or deliver an asset at some time in the future. For example, COMEX, a division of the New York Mercantile Exchange, trades a contract against which 100 troy ounces of gold are delivered.

For every futures contract, there is a central counterparty; the buyer and seller each have a contract with that central counterparty, not with each other. The central counterparty is known as a clearing house, and the creditworthiness of a clearing house is always excellent. If the miner sells and the speculator buys, the legal position is that each has traded with the clearing house. And if the miner were to sell and later to buy, the two contracts (both with the clearing house) would cancel out. All that would remain would be the profit or loss from the difference between the buying and selling prices. And hence both buyer and seller are exposed only to the credit of the clearing house.

The futures contracts are standardised, which eliminates costs of negotiation. A gold futures contract specifies in detail the minimum purity of the gold, where it must be delivered, its form, and every other relevant detail.

Futures contracts are traded on many different underlying assets. There are contracts on gold and platinum, on various kinds of wheat, on pig bellies and orange juice, on various grades of oil, on government debt, on equity indices such as the S&P 500 and the FTSE 100, and even on inter-bank interest rates. Each of these contracts specifies in detail what must be delivered at expiry: how much of what quality to where.

The value of a futures contract derives from the value of the underlying asset. For this reason, futures contracts, and many other types of tradable contracts, are known as derivatives.

COMEX was owned by NYMEX, which in 2008 was bought by the CME: specification of the CME gold future; allowed smelters on tab “Gold (GC) Brands”.

— JDAW, January 2022.

As an example, the following extract has been taken from the specification of the COMEX gold contract:

In fulfilment of each contract, the seller must deliver 100 troy ounces … of refined gold, assaying not less than .995 fineness, cast either in one bar or in three … bars, and bearing a serial number and identifying stamp of a refiner approved and listed by the Exchange. …

Delivery must be made from a depository located in the Borough of Manhattan, New York City, licensed by the Exchange. …

The first delivery day is the first business day of the delivery month; the last delivery day is the last business day of the delivery month.

The twenty-six approved refiners range from the Sheffield Smelting Co. Ltd of Sheffield, England, to the Union of Soviet Socialist Republics (which, it’s true, has disappeared, but there are still ingots bearing its hammer-and-sickle stamp). The three approved depositories are Morgan Guaranty Trust Company of New York, the Republic National Bank of New York and the Scotia Mocatta Depository Corporation.

The object is not to tire the reader with the detailed specification for this particular contract, but rather to emphasise that every futures contract has a detailed specification. Buyers and sellers alike know exactly what can be delivered against that contract, when it can be delivered and how it can be delivered. There is no ambiguity.

Let us return to the would-be gold miner. Assume that the miner sells a contract to a speculator. The miner and the speculator do not take each other’s credit risk, because both take that of the clearing house. But equally, doesn’t this mean that the clearing house has to take their credit risk?

The clearing house does not deal directly with the end-users, such as the gold miner. Clearing houses deal with brokers, who deal with the end-users. Clearing houses protect themselves by insisting that brokers take from their clients margin, a good-faith deposit of cash or bonds. The brokers must then post that margin at the clearing house.

So, the miner sells one contract. Let us imagine that this contract is the Sep 2001 gold contract, traded on COMEX, and it is sold at a price of $275. The price is quoted per troy ounce, but one contract is for 100 troy ounces.

There is an initial margin set by the clearing house, intended to be enough to cover the clearing house against a day’s move or so. For the COMEX gold contract, the clearing house currently sets the initial margin to be $13.50 per troy ounce, a total of $1350 on one contract. This initial margin protects the broker, and hence the clearing house, against a combination of a default and a change in the price of up to $13.50.

What would happen if the price were to rise by $3? Recall that the miner is short, that is, overall the miner has sold contracts and so in effect owns a negative number of contracts. An initial margin of $13.50 had been paid. Allowing for the $3 loss, only $10.50 of that initial margin remains. So the miner must top up the margin by paying a variation margin or maintenance margin of $3 per troy ounce to the clearing house, effectively paying losses immediately.

The speculator is long a Sep 2001 gold contract at $275, and like the miner paid an initial margin of $13.50. But when the price rose $3, the speculator made a $3 profit and so became over-margined, and hence is allowed to top down the margin by that $3.

So the clearing house simply transmitted the miner’s payment of $3 per troy ounce to the speculator. The effect of the variation margin payments is that losses are paid and gains are realised immediately, with losers paying the winners (via the clearing house) in cash almost immediately. This is known as mark-to-market.

The payment of variation margin means that everybody starts the day in the same effective position. A trader who bought at $260 and a trader who bought at $275 each start the day as if they had bought at $278. The cumulative profits up to that moment (of $18 and $3) have already been received.

So what happens at delivery? Let us assume that the price holds steady at $278 until delivery. At delivery, those who are short deliver gold, and those who are long pay $278 per troy ounce. This means that a trader who bought the contract at $260 will have paid a total of $260 per troy ounce: $278 at expiry, less the $18 received in the form of variation margin during the life of the contract.

When the outstanding position is closed, either by letting it run to expiry, or by repurchasing it, the initial margin of $1350 per contract is returned, with interest.

Gold is a convenient thing to deliver. It comes in the form of durable ingots with a high value per unit volume and per unit weight, so it is reasonably cheap to store millions of dollars’ worth of gold. Ingots are stored in a vault; delivering an ingot usually consists of no more than delivering a depository receipt. But delivering oil would be messier. Brent crude (crude oil from the North Sea’s Brent oilfield) only comes in supertanker loads. Delivering 1000 barrels, the size of a single futures contract on the International Petroleum Exchange in London, would be highly inconvenient and hence expensive. So a different delivery mechanism is used instead.

At expiry the exchange observes and records the price at which physical oil is trading. This is deemed to be the final price of the contract. All those owning contracts (all longs) are deemed to sell their positions at this price, and all those who have sold (all shorts) are deemed to buy back their positions at this price. So if someone buys December 2001 Brent at $25, and at expiry Brent crude costs $29.50 per barrel, the profit would total $4.50 per barrel, and all of this would have been paid in the form of variation margin.

If a market participant wanted physical delivery, this could easily be constructed. Someone who wants delivery of crude oil, and who had bought the contract at $25 per barrel, would take one extra step: to purchase oil in the market when the contract expires. The total cost of the oil would be $25 ($29.50 to buy the oil, minus the $4.50 profit received in the form of variation margin).

Contracts that have this form of delivery are said to be cash-settled. Cash settlement relies crucially on having a method of determining the final price that is fair, transparent and cannot be manipulated.

The above futures contract was on Brent crude oil. This is because the final value of the contract was the cost of Brent. But this cost is only a number: the same mechanism could be used to make a futures contract on any number.

That number could be the price of a barrel of oil. It could be the value of an equity index, such as the S&P 500 or the FTSE 100. It could be an interest rate or a formula involving an interest rate. Indeed, it could be any number at all, provided the method of determining that number has been specified in advance.

As an example, let us consider the FTSE 100 contract, traded on the London International Financial Futures Exchange (LIFFE). This settles against the FTSE 100, the equity market index consisting of the UK’s 100 largest companies. The contract specification describes the calculation of the expiry value, known as the exchange delivery settlement price (EDSP), as follows:

The EDSP is based on the average values of the FTSE 100 Index every 15 seconds between (and including) 10:10 and 10:30 (London time) on the Last Trading Day. Of the 81 measured values, the highest 12 and lowest 12 will be discarded and the remaining 57 will be averaged to calculate the EDSP. Where necessary, the calculation will be rounded to the nearest half index point.

The EDSP is thus determined in a manner that excludes transient errors or spikes in the prices. This method is transparent, robust and difficult to manipulate.

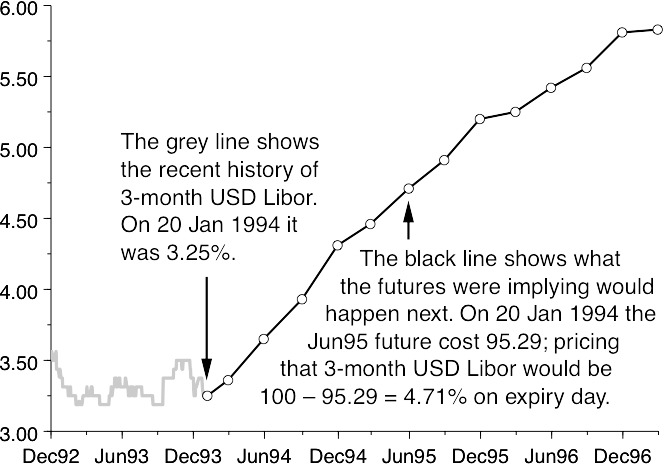

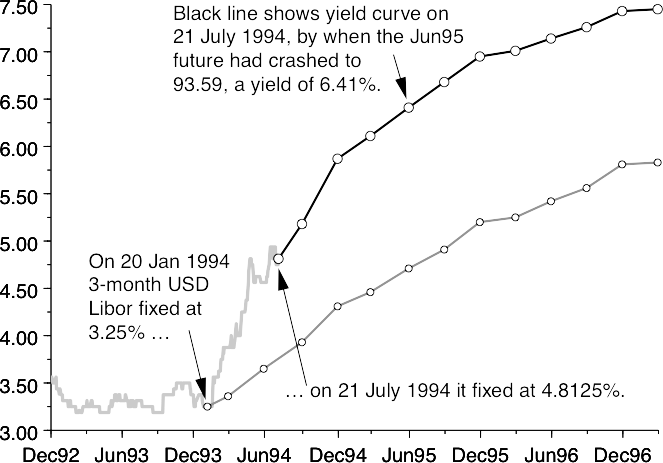

Among the most heavily traded futures contracts are the interest-rate futures; settling these requires a transparent and non-manipulable method of determining a short-term interest rate. The method used is known as a fixing, and the interest-rate fixings are of enormous importance to financial markets. They are used not only in interest-rate futures, but also in many other heavily traded financial instruments.

Did Lɪʙᴏʀ start in 1985 or 1986? From an archived copy of bbalibor.com: “In 1984 UK banks asked the BBA to develop a calculation that could be used as an impartial basis for calculating interest on syndicated loans. This led to the creation of “BBAIRS” – the BBA Interest Rate Settlement in 1985, which in 1986 became bbalibor.”

— JDAW, November 2019.

The fixings started in 1985, under the auspices of the British Bankers’ Association (BBA). The BBA fixes Lɪʙᴏʀ, the London Inter-Bank Offered Rate. At 11 am each London business day, the BBA asks sixteen banks for the rate at which that bank can borrow USD for 3 months. Each of these sixteen banks is asked to

contribute the rate at which it could borrow funds, were it to do so by asking for and then accepting inter-bank offers in reasonable market size just prior to 1100.

This is the rate at which inter-bank money is offered, for a deposit ‘governed by the laws of England and Wales’.

Sixteen banks submit rates; the highest four rates and the lowest four rates are discarded, and the central eight averaged. This average is the official fixing of USD 3-month Lɪʙᴏʀ.

Indeed, the BBA asks not just for 3-month US dollars. It fixes 1-day, 1-week, 2-week, 1-month, 2-, 3-, 4-, 5-, 6-, 7-, 8-, 9-, 10-, 11- and 12-month Lɪʙᴏʀ in each of USD, EUR, GBP, JPY, CHF, AUD and CAD. In some of the smaller currencies fewer than sixteen banks are consulted, but the principle is the same.

Mea culpa: this 2001 writing was excessively optimistic about the robustness of the Lɪʙᴏʀ fixings. There were problems, and I should have anticipated that they would be important.

Illiquidity. In the nineteen eighties and nineties, money markets were huge and liquid. A bank could phone a counterparty and ask for a price in multiple hundreds of millions of Deutschmarks. And, at least in the eighties, the swap market was smaller than this. It helps when the underlying market is larger than the derivative market: it’s not worth trading billions of underlying at off-market prices to make that off-market profit in a size of only hundreds of millions in the derivatives. But as credit risk was measured more accurately, and taken more seriously, the deposit market shrank. Meanwhile, the swap market kept growing. By soon after the 2008 crash, the deposit market had shrunk to almost nothing. Hence in July 2017 the speech by Andrew Bailey, Chief Executive of the UK’s Financial Conduct Authority, entitled The future of LIBOR, which announced that Lɪʙᴏʀ will last until end-2021, but not necessarily beyond that.