| Main index | Financial Markets index | About author |

Julian D. A. Wiseman

Abstract: the uncovered gilt auction on 25th March 2009 emphasises the importance of the DMO using an auction mechanism that does not punish lonely bidders.

Publication history: only at www.jdawiseman.com/papers/finmkts/lonely_bidders.html. Usual disclaimer and copyright terms apply.

Contents: Introduction: Germany; Why the problem is sticky; The UK’s gilt auctions; The price of an uncovered auction What to do? Footnotes.

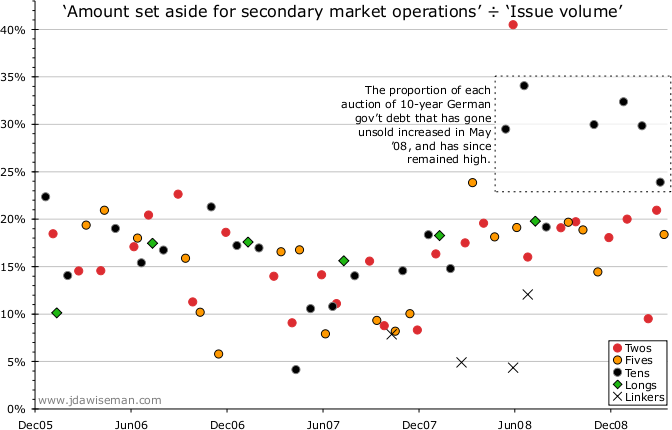

German government debt is sold by auction. The Bundesbank, acting as agent for the Deutsche Finanzagentur, reports the quantities of competitive and non-competitive bids received, the amount sold, and the ‘Amount set aside for secondary market operations’, that is, the amount to be sold later, that is, the amount unsold.

There are several reasons why some is unsold. The Bundesbank seems to have policy of always retaining some of each security for later sale. Of course, if there are too few bids, or too few bids at an acceptable price, some more of the auction must then go unsold.

The following chart shows the proportion of the amount for sale that was retained by the Bundesbank.

It is very apparent that 10-year auctions fell into a hole, starting with the auction on 28th May 2008 of the 4¼% July 2018. Of the seven auctions of 10-year Bunds from then until 11th Feb 2009, six have had more unsold than any auction in the previous few years, and five of these were by a large margin.

The problem appears to be sticky, in that Germany, having fallen into the hole, isn’t climbing out. This stickiness has a particular cause.

Consider the position of a lonely bidder, that is, a bidder at an auction that has received too few realistic bids. Being one of few bidders, all of that bidder’s realistic bids will be filled. And after the auction the world is then told that there were too few bids, and the price falls, or at least fails to rise. Thus the lonely bidder is punished.

Of course, if our bidder isn’t lonely, then the bidder’s bids are less likely to be filled. Rephrased: heads you win small; tails you lose big. That risk deters bidders, which increases the likelihood that much is unsold.

The route out of the hole, indeed the route that completely avoids the hole, is to have an auction mechanism that doesn’t punish a lonely bidder.

The UK’s auctions have slightly different rules and customs than those of Germany, different rules giving different failure modes. Germany has an established custom of the Bundesbank keeping back some of each issue (‘Amount set aside for secondary market operations’). So when bidding has been weak or insufficient, this unsold quantity has expanded.

But gilt auctions almost always result in the sale of the entire quantity (the only exceptions being the four uncovered auctions†1). This suggests that sometimes, and probably much more often than in Germany, the DMO is accepting a discount to whatever was the price just before the auction. (This has advantages and disadvantages, and is not being criticised here.) But it means that if bidders do start to fear that other bidders will fear that there will be too few bids, this fear can manifest itself in one of two ways:

more uncovered auctions;

auctions with a larger discount to the market price immediately before the auction.

The latter is less visible to those other than full-time market participants, so might be more politically acceptable.

Even one uncovered auction has had a steeper price than the authorities seem to be acknowledging. From the Financial Times†2:

Gordon Brown signalled that Britain would not announce a big fiscal stimulus in next month’s budget, as the failure of a gilts auction on Wednesday underscored concerns about the impact of further borrowing on the deteriorating public finances. The British prime minister has consistently advocated using next week’s G20 summit to agree a global fiscal stimulus—as demanded by Barack Obama, the US president—but he has been boxed in by dire public finances in the UK.

Yikes! The FT is reporting that the British government cannot invest to the desired extent in a better economy or in infrastructure, because gilt market participants won’t lend money to the UK government. Even if the FT has misjudged the cause of the missing fiscal stimulus, that it can plausibly report this is very bad. Financial markets are fragile: if market players start to believe that the UK has trouble borrowing, that belief might become self-fulfilling. Hence, presumably, the reassuring patter quoted elsewhere in the FT:

Downing Street said people should “not read anything” into the failure of a single auction. Robert Stheeman, chief executive of the UK Debt Management Office and responsible for issuing public debt, insisted the auction failure was not a disaster.

Robert Stheeman, chief executive of the DMO, insists that one auction failure is not a disaster either for the bond markets or the economy—it only becomes one if this turns into a regular event. “This does not tell us that there are big problems for the markets or the economy,” Mr Stheeman said. “However, if this were to become a trend and we saw a number of auction failures, then that would be more of a concern and we would need to talk to the Treasury about how we might address that.”

Happily, there is a solution, and the DMO has known of it for a while. Unhappily, it seems that the DMO has decided to ignore it. Last December the DMO consulted about the methods of distributing gilts†3, to which this author replied†4 with a description of an auction mechanism that is friendly to a lonely bidder. This reply was then followed by a presentation†5 at the DMO on 6th February 2009. On 18th March the DMO published the conclusions of the consultation†6, which acknowledged the suggestion but did not explain why it was not favoured.

So, some repeat advice to the DMO. Choose an auction mechanism that does not punish lonely bidders. The author’s reply†4 to the December 2008 consultation†3 described one such mechanism. If that isn’t liked, then give clear reasons why not and instead find or devise a different mechanism that does not punish lonely bidders. And don’t wait until the new government—the sooner done, the more the taxpayer saves.

— Julian D. A. Wiseman

New York, 26th March 2009

www.jdawiseman.com

†1 Of the 308 gilt auctions between 24th April 1991 and 26th March 2009 (so not counting switch auctions), only four were uncovered:

†2 The three quoted paragraphs come from three different articles in the Financial Times, each published online on 25th March 2009: PM backs away from new UK stimulus; UK public finance fears hit gilt auction; Failure of bond auction seen as one-off. Parts of these articles, lightly rewritten, appeared under the headline “Debt fears prompt UK gilt auction failure” on page 15 of the USA paper edition of the FT on 26th March.

†3 †3 Supplementary Methods For Distributing Gilts: A Consultation Document, 17th December 2008.

†4 †4 Methods for Distributing Gilts: A Reply, December 2008.

†5 Better Auctions and Better Products: A Presentation to the UK DMO, 6th February 2009.

†6 From ¶22 of the DMO’s Supplementary Methods for Distributing Gilts: Response to Consultation, 18th March 2009:

One respondent advocated issuing gilts by splitting each auction into a series of multiple ‘auctionettes’, each of which would be held one minute apart. The advantages of the proposal, it was suggested, would be to improve the price discovery process and reduce the execution risks faced by both GEMMs and the DMO.

| Main index | Top | About author |