| Main index | Financial Markets index | About author |

Julian D. A. Wiseman

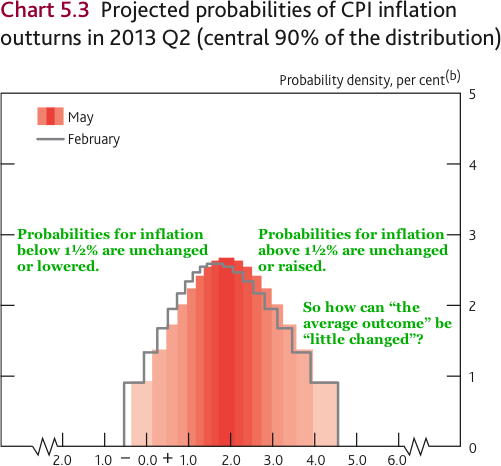

Abstract: The May 2011 Inflation Report has inconsistent descriptions of an inflation distribution.

Publication history: only at www.jdawiseman.com/papers/finmkts/20110512_inflation_arithmetic.html. Usual disclaimer and copyright terms apply.

From the The Bank of England’s May 2011 Inflation Report, Chapter 5, Prospects for inflation:

Although the most likely outcome for inflation is a little higher than in the February Report in the second half of the forecast period, the upside skew around the mostly likely path is judged to be smaller than in February, so that the average outcome, taking into account the balance of risks, is little changed.

Reproduced below is the diagram showing the February and May distributions of CPI inflation in 2013 Q2, this date being well into the “second half of the forecast period”. Green annotations have been added.

Observe that the probabilities for inflation below 1½% are unchanged or lowered, but for above 1½% are unchanged or raised. Probability has been moved from low inflation to higher inflation. So how can “the average outcome” be “little changed”?

Perhaps this odd inconsistency reflects the difficulty, in present times, of getting nine people with four different desired policies to agree on an inflation distribution?

| — Julian D. A. Wiseman 12th May 2011 www.jdawiseman.com |

| Main index | Top | About author |